If you’re interested in precious metals or platinum investing , it is an outstanding time to enter the marketplace. Working with a reputable firm is one of the first pre-requisites of success, and Monex has earned a name by providing buyers and sellers with an easy, safe, and reliable way to receive the highest returns from their investment. The company offers a wide variety of buying choices and has ingots, bullion, and coins that are offered in an assayed and hallmarked form that is essential for buyer security. In addition to purchasing precious metals in a hard format, buyers have plenty of other options that can facilitate trading.

While gold and silver may be what is traditionally imagined when thinking of precious metals investing, platinum is newer to the scene, but it offers a whole host of benefits and has some features that make it a proven choice for success. Any type of precious metal is unique in that it has an innate charm that has made it a store of value throughout time. Before paper money was in widespread circulation, many people relied on the use of precious metals to trade with each other. As a matter of fact, during the first few years of the United States, the paper currency was actually backed by gold that was held on deposit in federal reserves. While this has changed and the advent of electronic payment options has made paper money virtually obsolete, investors can still speculate on the changing prices of precious metals to earn money from their capital.

The Benefits of Platinum Investing

Platinum is one of the most-scarce precious metals, and data shows that production from mines is only equal to about 5 million troy ounces on an annual basis. As a comparison, the production of global gold mines is much higher and is nearly 82 million ounces annually. Silver production is also much higher than that of platinum, and the output of silver mines is about 547 million ounces on an annual basis. For these reasons, platinum generally trades at a much higher unit price, and it offers outstanding opportunities for investors to cash in on fluctuations in the market.

Trading Options

Platinum can easily be purchased from a reputable source that guarantees the precious metal in a certain quantity. Buyers can choose to buy and keep their own platinum and find ingots that weigh 10 ounces. When this type of purchase is arranged, the seller will usually ship the merchandise by a secure carrier and charge the market price at the time plus a small, nominal markup that helps to cover costs of minting and associated operations. Platinum ingots and coins are commonly available, and there has even been talk about the possibility of the United States government minting a special platinum coin to help avert any impending debt crisis. According to rumors and speculations, the coin would have a face value of $1 trillion and would be used as a way to pay down the national debt without having to restructure the current ceiling on government borrowing. While it is highly unlikely that such a coin will ever be minted, the mere talk about such an activity can help to fuel prices and drive the ticker for platinum higher. When buying platinum in the form of ingots or coins, the metal must be marked and assayed, much like the manner in which gold and silver are commonly traded.

Exchange-Traded Funds

While there is probably very little risk associated with purchasing and owning physical platinum, many investors prefer other techniques, and an exchange-traded fund is another way for anyone to benefit from the price changes that are associated with the precious metal. The funds are basically based on the value of platinum, and when the material’s price rises, a buyer realizes a total profit from their investing activity. On the New York Stock Exchange, platinum is purchased and sold under the ticker name, PHPT, and it is also available to investors on the London Stock Exchange, under the ticker symbol LSE.

Platinum Investing – Bank Accounts

Swiss banks offer investors another easy way to buy and sell platinum, and many of the leading firms have accounts that are priced in platinum, just like foreign currencies. While a buyer may not get to keep their physical platinum, their account represents a claim against the bank’s deposits that is transferred at anytime. Because platinum is highly liquid, it offers a number of benefits that may not be encountered with other types of traditional investing.

Platinum’s Industrial Uses

Another promising factor that can help propel the price of platinum has to do with the wide variety of different uses for the material. Platinum is much more than a simple store of value, and the metal has shown itself essential to a wide variety of applications. Compounds are commonly used in cancer treatments because the metal has shown an affinity towards attacking the rapidly growing cells that are associated with tumors. In addition, platinum is widely used in the automotive industry, and it is usually used in catalytic converters that help to reduce the effects of pollution. Growing demand in Asia for clean air and cost-effective transportation are expected to increase the industrial demand for platinum. Because of its industrial and commercial uses, the price for platinum is expected to continually grow over the coming years.

Platinum Investing 2013 Issues

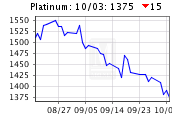

While the price for platinum reached a peak of about $2,252 USD per troy ounce in March 2008, largely as a results of production concerns that were related to power problems at mines in South Africa, the metal quickly lost much of the value that it had gained, and it was only worth $774 USD per troy ounce in November of 2008. As of September 18, 2013, platinum is priced at $1,462.00 per ounce. These few fluctuating values show just how much variability is in the platinum precious metal market, and it provides an insight into the amount of profit potential that exists for investors who do their research and use the markets as their inspiration.

If you are considering platinum investing 2013 is a great time to start, and you should be sure to consider all of the options that are at your disposal. Purchasing ingots from Monex or another reputable firm is an essential component of success because the products are hallmarked for purity and are easily traded at a later point in time. Platinum has historically performed exceptionally well as an investment vehicle, and its features make it a valuable addition to a well-rounded portfolio.

Works consulted:

http://platinuminvestingnews.com

https://en.wikipedia.org/wiki/Platinum_as_an_investment

http://profit.ndtv.com/news/your-money/article-investing-in-platinum-important-facts-you-should-know-320362